|

By Brenda L. Peterson, The Layoff Lady Don't Go It AloneLife is challenging when nothing in particular is happening. When you're going through a job change (especially one you didn't plan), it's even harder. While I'm a fan of self-reliance, I also know the value of finding people who want to support you and letting them do it. You're not weak for needing people. You are smart for planning ahead for what you will need. You Need Help Because This is HardI have been through a post-layoff job transition 7 times, and it is difficult each and every time. There is the fear that it will just never end, and you'll be drifting for eternity trying to find paid work where you can pay your bills--much less in a job you want. You worry that you'll have to settle for something that may be even worse than the worst job you've ever had. You also worry that you'll run out of money and not be able to pay your bills and lose everything you own and everyone you've ever loved. While your rational mind knows this is all pretty unlikely, there will be moments when everything seems hopeless. That's where your support network comes in. No matter how resilient and downright badass you are, doing this alone makes it way harder. People Want to Help You: Make Sure to Let ThemAs an extra added bonus, people want to help you! I'm always inspired by people who come out of the woodwork to check on me, tell me about an open position, thank me for helping them once upon a time, or offer to refer me for a role. Everyone has struggled with something at one time or another, and someone has helped them. Let other people help you. Building Your TeamIt also takes a village to get you through a career transition. Relying on one person for everything is all kinds of stressful. Know that people want to help, and it's a matter of figuring out what you need, letting people know, and reaching out to people when needed. Going through a job search is challenging, even in the best of circumstances. It can be even more challenging if you're starting from a layoff (especially the part where someone else got to make a big, uninvited life decision for you). Types of Help You NeedHere's a starter list of the types of help you may need during your job transition. More specifically, here is some of what I needed. Use this as a starting point and add details as it helps you:

Who Can HelpWhen it comes to help, I start with my inner circle--close friends and family. I'm also sure to widen my support team beyond them, too. I also move beyond that immediate group. I interact with my LinkedIn connections. I tap into online groups including job search groups, The White Box Club, and even LinkedIn groups focusing on networking or a content area (like sales enablement). I interact with in-person membership groups like ATD or the Omaha OD Network. Or I seek out non-work connections through social Meetup groups or activities. Sometimes, I just spend time in coffee shops to indirectly interact with other people. It's a matter of figuring out what you need and finding a person to help. Asking for HelpKnow, too, that there will be times when you need to straight up reach out to someone because you need help. Each person will have their areas of interest and expertise, so be sure to keep that in mind when asking for help. It's helpful to consider who you might contact for different needs. Here are a few cases where I reached out to different people to ask for help:

Learn More

0 Comments

By Brenda L. Peterson, The Layoff Lady The Adventure of Finding a New JobWhether you're gainfully employed but looking for the next right opportunity for you, or you're in career transition, job searching is hard. Here are three unfortunate job searching truths that can help you manage your mindset and emotions as you work through the ups and downs of this process. Truth 1: Job Seeker Time Goes Slower Than Hiring Organization TimeWhen you're a hiring manager, you have a ton going on, and only one of those things is hiring a new person. You're still trying to manage your team, meet deadlines, troubleshoot customer problems, and juggle all the people you're considering for your open position. In an interview, when one candidate asks about the hiring process, you tell them you should know who will move on to the next steps in the process "by the end of this week"--and at the time, you believe that is a reasonable deadline. Then there is a software release with a bug that causes three meetings to be scheduled with big clients, or someone ends up out on sick leave unexpectedly, or your child has to be picked up from daycare with the flu. Friday comes and goes, and getting in touch with a candidate falls off your radar until the next week. Meanwhile, as a job seeker, you put a note on your calendar that you'll know one way or another by Friday. Then you analyze every syllable you uttered in the interview, hoping you didn't say anything awful. You rethink a facial expression you interpreted as approving and wonder if it really was that at all. You suffer through Saturday, Sunday, and Monday, secretly worrying that you will never find another job. Ever. Instead of spiraling, take action to get you closer to your goals. After the interview, email the hiring manager a thank you message and consider sending them a LinkedIn connection request. Put a note on your calendar for a few days after the hiring manager said they would contact you. Reach out to them at that time, including a few pleasantries, reiterating your interest in the role, and asking for an update. Will you get the job? It's hard to tell. Either way, you did your part. Remind yourself that you won't get every job you apply for, and reflect to see what you can learn from it. At the very least, pat yourself on the back that you didn't over-follow up (which is often worse than not following up at all), and be sure to focus on more than one job opportunity at a time. In addition, network with three more people and apply for three more jobs. Truth 2: It's Not "Your Job" Until You Receive A PaycheckInevitably as a job searcher, you run across it. THE job. It's the one you know is meant to be yours. It's perfect--easy commute, a great title, the go-to company, exactly what you are qualified (and want) to do. In your head, you think--this is MY job. You picture your new business cards, where you'll park, and how you'll introduce yourself as the "Director of Awesomeness" for this perfect company. If you're still working, you may be dreaming about the day you hand in your notice--or get excited knowing you won't have to finish a dreaded project because you'll be elsewhere. You think--why should I even bother applying for anything else because this one is SO my job! Except, well, it's not actually your job yet. You're looking at it and seeing yourself in it, but it's not real. You don't work there. No one is sending you a paycheck for it. They don't even know your name yet. You may very well still work at your company in a few months when the project you're not excited about is due. While this MAY be the job you eventually get, it's not a done deal yet. You know what else? It may not end up being your job. Apply for that job--even work hard to get it. Know, though, that you may end up not even getting called in for an interview. This doesn't mean you're not still an amazing professional with valuable qualifications. Remember, there are always many things going on when companies hire. There may be an internal candidate, a previous coworker of the hiring manager, someone who has a referral from a college friend, or someone who has even slightly more of a qualification that didn't make that job posting. When you're a hiring manager, you have a ton going on, and only one of those things is hiring a new person. You're still trying to manage your team, meet deadlines, troubleshoot customer problems, and juggle all the people you're considering for your open position. In an interview, when one candidate asks about the hiring process, you tell them you should know who will move on to the next steps in the process "by the end of this week"--and at the time, you believe that is a reasonable deadline. Then there is a software release with a bug that causes three meetings to be scheduled with big clients, someone unexpectedly ends up on sick leave, or your child has to be picked up from daycare with the flu. Friday comes and goes, and getting in touch with a candidate falls off your radar until the next week. Meanwhile, as a job seeker, you put a note on your calendar that you'll know one way or another by Friday. Then you analyze every syllable you uttered in the interview, hoping you didn't say anything awful. You rethink a facial expression you interpreted as approving and wonder if it really was that at all. You suffer through Saturday, Sunday, and Monday, secretly worrying that you will never find another job. Ever. Instead of spiraling, take action to get you closer to your goals. After the interview, email the hiring manager a thank you message and consider sending them a LinkedIn connection request. Put a note on your calendar for a few days after the hiring manager said they would contact you. Reach out to them then, including a few pleasantries, reiterating your interest in the role, and asking for an update. Will you get the job? It's hard to tell. Either way, you did your part. Remember that you won't get every job you apply for and reflect to see what you can learn from it. At the very least, pat yourself on the back that you didn't over-follow up (which is often worse than not following up at all), and focus on more than one job opportunity at a time. Whenever you fall in love with a job or think of something as "your job,” make an extra effort to apply for additional jobs--or at least game out what happens if you do not get the job. If the job you see yourself in works out, great. If not, you're still working towards your ultimate goal of finding a new role (complete with a paycheck), whichever one that might be. In addition, network with three more people and apply for three more jobs Truth 3: You Only Need One Job.Applying for jobs is a process. Looking back at my records, I have typically applied for between 40 and 100 jobs when I've been in career transition. It's easy to get discouraged. If you're working and looking for something else, you might be more selective in your applications and feel especially attached to an opening you see. Remember, not every personal referral, application, or interview will lead to an offer. Again--sometimes you apply and hear back a fat lot of nothing. Sometimes, you might get a quick rejection from a job only to see it reposted a week later. In those cases, it can be hard to see that they don't even have a good candidate, but they know it's not going to be me. That one smarts. It's also hard when you interview for a role multiple times only to hear that you didn't get the job. Even though they genuinely liked you, you didn't get it. Maybe you were a close second, perhaps they went with an internal candidate, or they ended up not filling the position. There is so much rejection in the job search process that you’ll inevitably feel sad and like maybe there is no hope for you finding the right next job for you. Instead of spiraling, take action to get you closer to your goals. At the end of the day, though, you only need one job. You only need one organization to tell you “Yes.” You only need one place where you and the employer agree to work together. Sometimes, it's helpful to remind yourself that all those no answers get you to the one yes you need. The trick is that you don't know which one will be that yes. You have to keep on keeping on until you find it. In addition, network with three more people and apply for three more jobs. Learn Moreby Brenda L. Peterson, The Layoff Lady Network Building in the BeforetimesPre-pandemic, "networking" typically meant attending in-person events, shaking a few hands, and having a somewhat meaningful conversation with another human. While in-person opportunities are again plentiful, webinars continue to be popular since they are a flexible way to bring people together to learn. Be sure to think of your network during virtual events, too. Connect with Webinar AttendeesLike many people, I have attended (and delivered) approximately a bijillion online meetings, trainings, and interactive instructor-led sessions. I've been approaching these sessions with a mind towards not just attending, but also making new connections. Although the process differs from in-person interaction with people, I have managed to connect with more people (and often form more meaningful connections) than attending in-person meetings and “working the room.” As someone who runs introverted and communicates effectively in writing, this was an opportunity to turn webinars into a bonus network-building exercise. Your Personal Webinar BrandingWhen attending a webinar, I make sure that people are able to see who I am, my full name, and a picture, if at all possible. I use the same photo I use on LinkedIn so that people associate me with that picture. I also make sure that my first and last name are present so people have a chance of being able to find me after the session--or will recognize my name. In addition, during the webinar, I interact during the session. This usually involves commenting in the chat when prompted--which is also an opportunity for other attendees to see my full name. During any small group interactions, I'm sure to turn my camera on so people can see my face, hear my voice, and see my name. If the presenter asks people to share out loud, I usually turn on my camera, and share my thoughts. Again, this is another opportunity for people to hear my voice, see my face, and see my name. Each of these "impressions" helps people start to get to know me at least a little bit. Finding Potential ConnectionsDuring a webinar, I often take a screenshot of the participant list and a gallery of attendees if people are on camera. Whenever possible, download the chat from the session. This helps me identify who was active in the webinar and gives me additional information on anything they might have shared during the session. I often make notes on notecards during sessions to help me remember who might have said what and key content covered. All of these details can help me when interacting with attendees later on when I send LinkedIn connection requests. Researching Potential ConnectionsAfter attending a webinar, here is my process for adding new LinkedIn connections:

One Option: Personalizing a Connection RequestPersonalizing connection requests is a great way to start building a relationship with a new professional contact. Here are the key components I include:

Personalized Connection Request ExamplesHere are a few examples of messages that you can use to invite people to connect. Currently, LinkedIn allows you to include up to 300 characters when personalizing connection requests. Hi, Jen. I see we both attended today’s White Box Club meeting. I’m also in career transition and seeking a new role in learning and development. Let's connect! I'm also always up for a 30-minute "virtual coffee" meeting to discuss how we can help one another as we job search. --Brenda Hi, Jack. Great to interact with you a bit at this morning's Excellence Share. I love sharing ideas with fellow L&D professionals. Let's connect! --Brenda Hi, Javier. I see we both attended today's "Sales Enablement Best Practices" webinar. I definitely enjoy learning from this group. Since you mentioned that you are job searching, be sure to check out The White Box Club on Meetup to help you as you find your next role. Let's connect! --Brenda Other Options: Showing Your Value as a ConnectionNow that LinkedIn limits the number of personalized connection requests those with the basic membership receive each month, sending personalized connection requests might not be an option for you. In those cases, here are a few other options for helping to show your value to a potential connection:

After The Initial ConnectionHow do you further nurture that relationship? Here are a few ideas.

Continue to Build The RelationshipAfter connecting with people initially, be sure to continue to nurture those connections. Posting useful content, and occasionally messaging people is one way to do that. Ideally, you can add value to the relationship before you are in a position where you need to ask those individuals for help. Learn Moreby Brenda L. Peterson, The Layoff Lady Welcome To The SuckWhether you are in career transition and looking for a new job, or employed and looking for something new, job searching is always challenging--partly due to all of the uncertainty you'll face as you "wait for your life to start again" as you search for the next right role fro you. Suffice it to say that job searching can be full of obstacles that make the process hard to manage. Knowing the possible issues is the first step towards figuring out how to mitigate each challenge and move forward. Here are five unfortunate reasons I have discovered while working through job transitions and a few coping strategies for dealing with each. Reason 1: You Won't Always Interview For "The Perfect Job."Congratulations! You just found THE PERFECT JOB! You have all of the required and preferred qualifications! It's at the right level with your dream company, and you even know someone who works there who will say great things about you! Surely your days of job searching are coming to a close because you are the purple squirrel for THE PERFECT JOB! Enter reality. I'm sorry to say that you may not even manage to get so much as an initial phone screen for this position. Even when you feel like the job was tailor-made for you, it may not work out the way you want. Why might that happen? For one, the position may not actually be available. Some organizations post job openings to gauge interest in the position even though they have no solid plans to hire anytime soon. Conversely, the role may have been open for a while, and the selection process may be well underway. There could also be an internal person who will take the job without additional people being considered. In some cases, companies may have a policy that they need to post positions externally for a given length of time, even though they already have a candidate in mind. Still other organizations may decide part way through the hiring process to leave a position unfilled but not remove it from their posted jobs right away. Assuming the job is really, and for true accepting applicants, there may still be issues. For one, key organizational stakeholders may lack common agreement on what a job role will do and what constitutes being a well-qualified candidate. Decision makers may also each have their own non-negotiable requirements for the qualifications for the potential hire--which may or may not relate to the person's ability to do the job. Remember that no matter what the issue is, it seldom has anything to do with you personally. It's just the life of recruiting for and trying to fill positions with the best candidates they can find--sometimes with people who are (unfortunately) not you. Coping Strategies

Reason 2: People Who Aren't Great At Their Jobs Will Make It Hard.Remember a time at your last job when you had to deal with someone who was not great at what they did for a living? Like the rude salesperson who didn't do their paperwork correctly and caused you to lose out on a great deal? Or the manager who approved your time off request months ago, then decided to "unapprove" it a week before your vacation? During your job search, you'll realize those people exist in other organizations, too, and they sometimes stand between you and the job you want. It could come in the form of an administrative assistant who is supposed to coordinate your travel for an in-person interview--who didn't make reservations and then went on vacation, leaving you scrambling to find someone else to help. It might be the person conducting initial phone interviews who didn't realize that learning experience design and instructional design were the same thing and screened you out. It may even be an insecure possible future coworker who wants to avoid hiring someone who might outshine them. Like the rest of life, things are not always "fair." You may not get the job, even if you are a strong candidate. And so it goes. Coping Strategies

Reason 3: Along The Way, Someone Will Dislike You.I don't know about you, but I am friggin' delightful. I'm also able to connect and get along well with most people. However, during the interview process, no matter who I am or am not, it will not match what someone else thinks the candidate for the position should be. Whether they thought I should have smiled more, made a different outfit choice, or given more detailed examples, someone's negative reaction to who I am may take me out of the running for a job. People often have their own pet theories about what they'd like in a coworker, manager, or direct report. They may be convinced that having the title "account manager" is pivotal for success, that all candidates must have a master's degree, or that people who ride horses are pretentious. You might also have the misfortune of reminding them of the mean girl in high school and BOOM--instant dislike. Again, life isn't necessarily "fair." Coping Strategies

Reason 4. The Process May Be All Over The Place.The job interview process can be anything from one interview to many, many, many interviews, depending on the organization and the role. Typically, I expect to have a phone screen with an entry-level HR person to confirm that I can speak in sentences, an in-person interview with the manager and potential coworkers, and a final interview to demonstrate skills and/or meet with a company VP. In addition, a given employer may want you to do more to show that you have the skills necessary to do the job. For example, you might be asked to pass written assessments, submit work samples, present to a group or complete a project. They may even have you come into the office for the day and "work" as if you are already in the position you are applying for. Interviews could take place over the phone, via web conference, through email, in person, or (more likely) a combination of all of the above. Some companies will have a pre-defined, structured process for the pacing and format of interviews. Other organizations will appear to be making it up as they go along. You may also inadvertently skip steps and realize near the end of the process that you should have talked about a basic topic like salary range or work location. Sometimes, it may seem that the interview process is never-ending because you have yet to talk with every single person in the organization. Coping Strategies

Reason 5: Their "Fast" And Yours May Be Different.I remember being a child and how LONG the year seemed. It always took forever to get from my birthday at the end of August to Christmas. Enter adulthood. I find myself consistently marveling that it's already whatever day/month/season it is because it seems it was just that other day/month/season. In this scenario, your employer is the adult, and you are the child. Some companies will be motivated to fill positions and move quickly. In contrast, others might have days, weeks, or even months between your contact with them--all because something that wasn't filling that position became a priority. What about that two days the employer estimated it would take them to contact you? It may turn into a week or two. Since they're busy addressing customer issues, traveling to client sites, and doing their expense reports, they didn't even realize it took that long. Or, as any job seeker doesn't want to hear, you may not be getting the job. Responding to a candidate quickly usually shows that the potential employer is interested. In many cases, taking longer to respond may indicate lagging interest. Such is how the whole process works. Coping Strategies

Learn MoreBy Brenda L. Peterson, The Layoff Lady The Value of Professional NetworkingWhen it comes to job searching, professional networking is a critical component of success. Ideally, you make initial connections with people through LinkedIn (maybe even after meeting them in person or at an online group event). While this is a great start, there is value in building relationships beyond that initial connection. A 1:1 meeting can significantly strengthen a networking relationship and help you learn how you and your new connection can help one another succeed. About 1:1 Networking MeetingsSo what exactly is a networking meeting? Back in the day, I remember hearing people talk about doing "informational interviews." In short, if you were interested in having a particular job or working with a specific company, you would contact an organization or individual and ask if they would meet you for an informational interview. In this 1:1 meeting, which could take place via phone or in person, you might learn about the company, what they are looking for, skills to acquire, and more. It also allowed you to start to build a relationship with a company--or a possible advocate in the person doling out said information. Fast forward to now. Today, a networking meeting is typically between you and another person deciding to spend a half hour-ish together. This meeting, sometimes called a coffee chat, could happen virtually via Zoom or in person, often over coffee. If you're job searching, the typical focus will be on how to progress in your job search. Someone may agree to a networking meeting because you have things in common (like a field of work, background, professional goals), because they are generally committed to helping people when they are job searching, or because you have a mutual acquaintance to ask that person to meet with you to help you out. Networking Meeting = Informal InterviewWhenever you have an opportunity to meet one-on-one with someone, remember that you are taking part in a type of informal interview. Whenever I meet with someone in career transition, my goal is to help them figure out their next steps, offer advice (if they ask and are interested), and give them ideas on further steps they might take, including who they should speak with next While I go in with this idea, the amount of help I'll provide also depends on how this networking meeting goes. Ideally, we have a good, productive conversation, and I think to myself, "I totally want to help this person more." If the meeting goes well, I'll refer them to specific resources that might benefit them (like a networking group they might want to join, a company to check out, someone to follow on LinkedIn) and even put in a good word for them to have a networking meeting with someone else who might get them closer to their goals. In addition, if it goes REALLY well, this is a person who I'll refer to others for openings, pass on job opportunities, and maybe even hire someday. If the meeting doesn't go well, I'll share a few resources, but I may not be willing to help them as actively moving forward. Remember, any interaction you have with people will impact their desire to help you in the future. Types of Networking MeetingsHere are a few common types of networking meetings:

Networking Meeting Best PracticesHere are a few best practices for networking meetings:

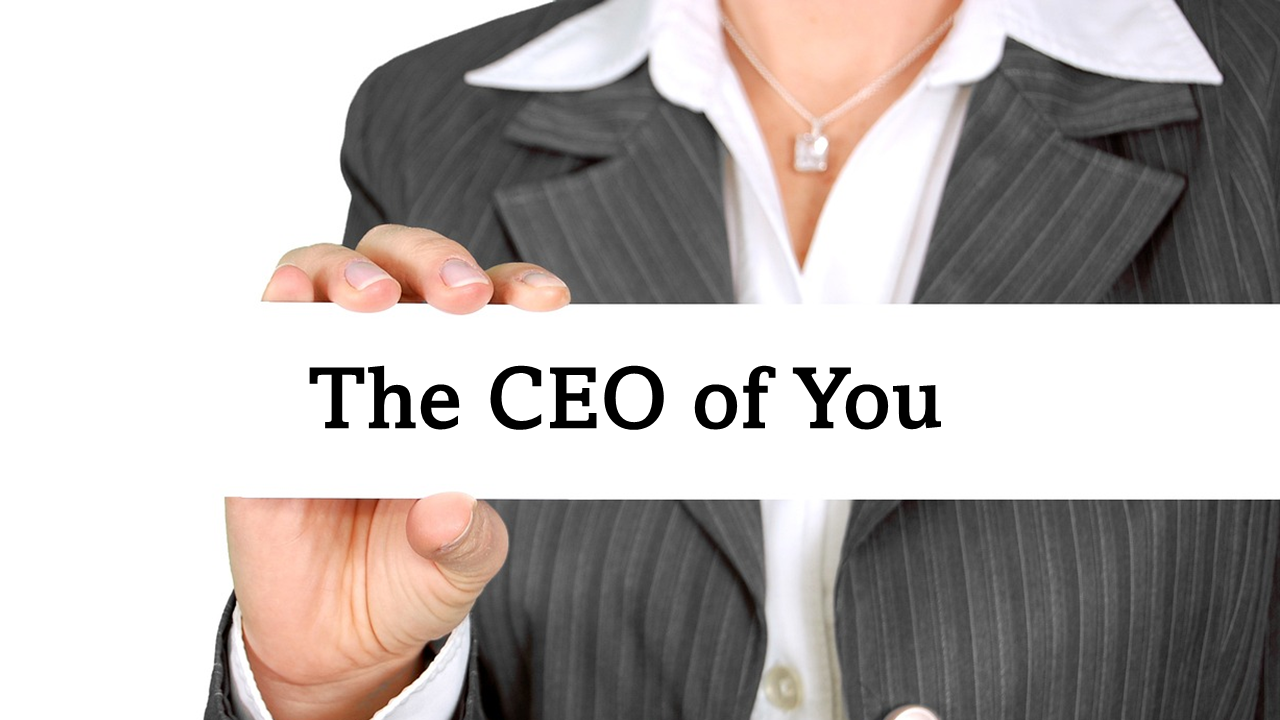

The True Power of Networking MeetingsWhen people talk about how they "networked" into a new job, typically, that means they leveraged their initial connections to help make inroads with new contacts, who helped them get closer to a new position. The holy grail of networking meetings is when the person you meet with agrees to introduce you to someone else they know who could help you. That process repeats until you're talking to a hiring manager or influencer who can help you get an interview for a job. Having good networking meetings is a critical step in that process. Learn MoreBy Brenda L. Peterson, The Layoff Lady Employer-Focused Career PlanningWhen you think about your career, you may think in terms of your current job title, what the company needs from you, and how your job might change based on organizational needs. This employer-focused mindset prioritizes the success of the business above all else. Often, the career planning offered by your employer is a part of their overall succession planning and focused on making sure their workforce has the skills to address anticipated future company needs. It's important to remember that the needs of a given business will change over time, as will company leaders, the market, the economy, and more. If that employer's needs no longer align with the skills you have and the salary they pay you for those skills, the company may make the business decision to "go in another direction." The end result may be them finding someone else to do the work they need done regardless of the skill set they encouraged you to develop. Your New Mindset: Realistic OptimistIn much of life, having the right mindset makes all the difference. I choose to be a Realistic Optimist. That means I acknowledge the challenges inherent in situations and also realize that I have the power to make choices that will help me achieve a positive result--in this case, a career that is meaningful and fulfilling for me. Let's look at a few of the realities of work and your career:

Let's also look at what that means for you:

Given these realities, thinking of your work future only in terms of who is currently signing your paychecks is not the wisest course of action. Instead, it's time to shift how you think about your work life. You can not afford to prioritize an employer's needs over what you want and need from your career. It's time to give yourself a promotion! Congratulations! You are The CEO of YouLeveraging your Realistic Optimist mindset, you are now no longer just an employee doing what your current employer wants and needs you to do. Now, it’s time for you to think of yourself first and foremost as the Chief Executive Officer of your own company and the business of you. This makes you the CEO of You. As the CEO of You, you are looking for employment that is a good business arrangement for you. Just like the executive team at a company needs to make tough decisions for the organization’s greater good, you need to make decisions that are in the best interests of you and your household. Adopting this mindset will change your life. The Business of YouAs the CEO of You, it’s time to think about what success looks like for your business. What are your assets? What are your marketable skills? Which company or companies should be your business partners? When is it time for you to end a business relationship that is not working? When is it time for you to pursue a new opportunity better aligned with your life? Whereas you as an employee may feel like you do not have any options, you can't afford to think about your livelihood just in terms of what your biggest client (your current employer) needs. Instead, you need to make decisions for the good of your business as the CEO of You. One of those is determining how to protect one of your greatest assets–your ability to earn a living by leveraging your knowledge, skills, and expertise. You also want to stay mindful of all the aspects of the employment decisions you make and how they impact your overall wellbeing--including your career, physical, financial, social, and community wellbeing. Your Short and Long-Term GoalsAs the CEO of You, think about your long-term goals. Just like the company's CEO does not make decisions based on what other companies think they should do, you need to do the same. Regardless of other people’s opinions, make the right decision for you and your household. Align your next steps with your overall goals. Think in terms of preferences and priorities. Remember, too, that you’re not just the CEO of your career but the CEO of all aspects of you. If you're in career transition and searching for a new role, this means not taking “any old job” unless you decide that is the right move for you. If you're employed by an organization that wants you to learn a new skill set, you get to decide if that interests you and how you will invest your time, talents, and money to build those skills. You get to decide what is a valuable opportunity for you and decide your next steps as you work toward aligning what your employer needs and what you want to do. This also means that your business decisions may change over time as the environment changes. You can also change your mind about the right job for you if your current role has enough value for you to stay, when it is time for you to do something else, how you want to change direction, and more. Adjusting Your Business StrategyAt the end of the day, remember your role as the CEO of you and make a decision that aligns with your overall career and life goals. If that means quitting a job that makes you miserable regardless of the short-term financial consequences, you can do that. If you want to leave a job that your friends say should be your dream job, you get to make the right decision for you. If you decide to take your career in a whole new direction that others might think is too risky, you get to weigh your options and go in the direction of your choice. As the CEO of You, you are the driver of your career and your life. Act accordingly. Learn Moreby Brenda L. Peterson, The Layoff Lady Interviewing for a New RoleAs a many-time layoff survivor, I have done quite a few job searches and had lots of interviews. Not long ago, I read an article about a job searcher who opted out of one hiring process. He did this after making it through three rounds of interviews and having the organization ask about arranging the next six (yes, 6) rounds of interviews. I felt compelled to share my story about one seemingly never-ending interview process. Unfortunately, like with many things in life, it took a bad experience to teach me how to make better decisions. Job Interviewing Boundary Setting is HardLet me start by taking a moment to acknowledge that this is not always easy to do. It is hard to set boundaries when you’re hip-deep in a job search, especially when you’re unemployed. The longer the search goes on, the easier it is to tell yourself that you’ll summit Everest if a potential employer asks you to as part of possibly FINALLY getting a paying job. Consider this your reminder to realize that jumping through more and more hoops doesn’t necessarily mean that you’ll end up with a job at the end of the process. Do your future job-searching self a favor and think through what your boundaries are when it comes to participating in a given company's hiring process. (We'll revisit this a little later.) The Perfect Job! (or was it...)During this particular job search, I was laid off at the end of the summer. From previous job searches, I hoped to find a new position before Thanksgiving because otherwise, it might be until February or March before I secured a new role. I was very excited when I ran across THE PERFECT JOB! It was an opening for a training director position within an easy commuting distance where I even knew someone who had connections within the organization. Lesson Learned: Don’t fall in love with a job. Even if it seems like “the perfect job,” it is not yet “your job.” Apply, and hope for the best, but keep on applying. Until you have an actual accepted job offer, it is not “your job. The Inside ScoopI met with my professional connection, and they filled me in. I learned about the organization, their clientele, their mission, the key players in the hiring process, and helpful background information. My connection even put in a good word with the organization (they had left on good terms.) I also learned that the company had some turnover in this position, so they were trying to make sure they did their due diligence and hired the right person this time around. Lesson Learned: Gather and synthesize information even when you’re excited because you found THE PERFECT JOB. This company having gone through two people in the role in a relatively short time period and being concerned about making another hiring misstep is something I heard and noted. Still, I didn't really take it to heart. In this case, the company was trying (maybe a little too) hard to hire the right person for the role. It may have also indicated something about the company or the position that caused people not to stay. My future self knows to synthesize information more carefully--and not overemphasize only the good things. The Phone InterviewsI applied, and my connection put in a good word for me. The company quickly reached out to me for an initial phone screen. Then a phone interview. Then another phone interview. Then yet another phone interview. After four phone calls—each where the new interviewer seemed excited about me as a candidate and talked about who else I needed to talk to—I started to wonder what the game plan was for this whole process (aside from their overwhelming and often stated goal of not to make a hiring mistake). Lessons Learned: In the initial phone screen or the first interview, ask about the hiring process. This includes their estimate of when this process will be over (a week? a month? 6 months?) and the critical steps in the process. Decide your boundaries and be ready to decide the number of hours you are willing to dedicate to interviewing for this role. Remember, you are interviewing them, too. Make no assumptions. Don't get so excited that they keep wanting to talk with you that you keep going, not knowing how many hoops there are to jump through. The Work SamplesIn addition to talking to different interviewers on multiple occasions, the company wanted to see instructional design work samples from me. I emailed work samples and reviewed them with a subject matter expert who was well-versed in adult education and instructional design. They complimented me on the trainer guide, videos, and job aids I had created. They told me they were impressed with my work and learned from what I told them. At this point, they told me the next step was for me to meet with the company founder. Lessons Learned: Have a portfolio online that people can access, or let people know that you are happy to review work samples (and your process) with them in an in-person or Zoom meeting. I keep my work samples online with a note that these are intended to showcase my work and that they are not to be downloaded and distributed. The Zoom MeetingsI was excited to meet the company founder, who was also a published author. In preparation, I bought and read their most recent book, researched their accomplishments, read their blog articles, and reviewed their body of work. During the interview, we had a great conversation, which included a lot of “when we work together” and “next steps” language. This meeting was followed by multiple Zoom meetings with different stakeholders (again, one at a time) explaining the next steps in this process—which they called an “in-box experience.” During this phase, I would come into their office and work for a half day. I would have a chance to interact with multiple people I would work with, including consultants and a client. This would require me to sign a non-disclosure agreement, work on a project for an actual client, and present information to a client. Lessons Learned: No matter how many interviews you have, or how much they seem to like you, remember you do not have the job until they have made you an offer and you have come to an agreement about your compensation. Remember that the goal of this process is that the employer decides if they want to work with you, and you decide if you want to work with them. Looking back, I'm frustrated with myself that I invested SO MUCH TIME with this potential employer without talking about salary expectations. The In-Box ExperienceThe Wednesday before Thanksgiving, at 8:00 am, I arrived at the company's downtown office location for my in-box experience. I brought my computer and the work I had done so far. (BTW--there was a project and pre-work that I did, which took way too long. Holy time suck.) I was told that I needed to use their computer for my work that day. During the four hours that I was there working (for free) for them, I had an in-person panel interview with people I had talked with via phone, interviewed via Zoom with a consultant, ran a project meeting, completed work on instructional materials for a client, and got feedback on my performance along the way. I had a final conversation with one of the decision-makers before ending my day. I was told I'd hear back early the following week. Lessons Learned: Determine ahead of time how much you are willing to do for a role, and when to call it. Remember, you're interviewing them, too. And, for the love of God, don't do a ton of unpaid labor for a business that is not paying you for your work product. Thanks, But NoIn the middle of the following week, I got a call. It was very brief. Thanks for my time, but they had decided not to proceed with me as a candidate. If I like, though, they would be willing to add me to their possible consultant database for future contract work. Lesson Learned: Never again. In short, I spent about 45 hours total, including about 15 hours of unpaid work that I did for the company, to end up with no job offer. Time to transition all of these lessons learned into new personal guidelines. My Fancy New Job Search BoundariesRemember the boundary setting I mentioned before? Here's where we revisit it. After going through this process (and getting mad all over again while writing this article), I am reminded of the outcome of those lessons learned for me.

Learn MoreBy Brenda L. Peterson, The Layoff Lady About The Seven Layoff LessonsThrough my seven layoffs and many conversations with others in post-layoff career transition, I have learned seven core lessons:

About Layoff Lesson Seven: Assess, Adapt, and Rise AboveWhen you’re searching for a new job, there are always challenges. Like with any system you put in place to solve a problem, it’s helpful to compare the actions you’ve been taking to your results. It's valuable to review where you are getting stuck during the hiring process and updating what you're doing so you can see more success. Let's look at some of the challenges you might face. Interview Progression IssuesAfter you apply for a job, your goal is to be selected for an interview. That process usually includes an initial phone screen, one or more face-to-face interviews, and then a job offer. Let’s look at possible places you might get stuck and how to evolve your approach.

Additional Job Search ChallengesEven when you have good results with your overall job search and hear back from companies on specific roles, you’ll still face challenges. Let’s look at a few:

You are the CEO of YouAt the end of the day, remember your role as the CEO of You and make a decision that aligns with your overall career and life goals. That might mean adjusting your requirements as your search goes on or holding out for what you really want. You get to decide what matters most to you and change your mind as needed. For The Whole StoryFor all the information on each of the seven lessons pick up a copy of my book Seven Lessons From Seven Layoffs: A Guide. Learn MoreBy Brenda L. Peterson, The Layoff Lady About The Seven Layoff LessonsThrough my seven layoffs and many conversations with others in post-layoff career transition, I have learned seven core lessons:

About Layoff Lesson Five: Help People Help YouLife is challenging when nothing out-of-the-ordinary is happening. It's even harder when you're going through an unexpected job change. While I'm a fan of self-reliance, I also know how important it is to find your people and support one another as you go through challenges. You're not weak for needing people. You are strong because you know the value of building and leveraging relationships to help get you through trying times. I have found that people genuinely want to help. In many cases, though, they might not know what you need. Not only is it vital that you seek out help when you need it, but you need to figure out what type of help you need. One Career Transition RevelationHere's something that might surprise you. When you tell people that you're looking for a new job, this is when you will discover that many people don’t know exactly what it is you do for a living. Instead of being taken aback that they don’t know, use this as an opportunity to learn how to tell them what you want and need during your career transition--and it's much more than just a new paying job. Figure Out What Life Help You NeedFirst off, you need to figure the types of life help you might need:

Figure Out What Job Search Help You NeedIn addition, you need to figure the types of job search help you might need:

It Takes a VillageOnce you have a better idea of what you need, make sure you don't expect one person to fill all of these roles. Think about who could help you in each area and reach out to them. Leveraging Your Professional NetworkLinkedIn is my goto tool for building and managing my professional network. It's importan to make sure your LinkedIn profile represents you well, and that you showcase your experience and the value you bring to others, and to a new role. There is also an art (and a process) to asking people in your professional network in a way that is mutually beneficial. For The Whole StoryFor all the information on each of the seven lessons pick up a copy of my book Seven Lessons From Seven Layoffs: A Guide. Learn MoreBy Brenda L. Peterson, The Layoff Lady Layoffs Happen All The TimeIt starts like any other day. Then, it takes an ominous turn. Whether you were invited to an ambiguously titled last minute meeting, received an awkward email in your personal email notifying you of your last day, or are perp walked to HR on your first day back from vacation, you are now among the newly unemployed. Welcome to the suck. Now What Do I Do?Even if there were buyout rumors, a quarter with low sales, or a new company direction, being part of a reduction in force (RIF) is still surreal when it happens to you. It's hard to know what to do with yourself when you find yourself unexpectedly out of the job. It's time to redirect your attention. Your New Focus AreasThe work problems you had an hour ago are gone. Along with your freed-up future come very different challenges. It’s time to shift to these top three focus areas:

Your Guiding PrincipleAlong with your new focus areas, your overall guiding principle is not to do anything counterproductive (or downright dumb) as you figure out your post-layoff next steps. Your Never-Do List Here are the career-limiting moves that will make your life harder. Instead of springing into action, stop, think, and then just don't do the following:

Your Think-Before-You-Consider-Doing List Here are a few things you may want to do at some point, but that require thought and a plan before you move forward. At the very least, sleep on it before you do any of the following:

Now that you are at least somewhat inoculated against creating utter chaos for yourself, let's get back to those top three focus areas. Focus Area 1: Process Your EmotionsLosing your job can be an emotional roller coaster. An unplanned job change is a stressful life event on par with getting divorced or going to prison. Just like dealing with a death in the family, you’re dealing with the death of the future you thought you had. Losing that imagined future is a significant loss that needs to be addressed. Figure out how you will cope with these changes. While distracting yourself from the unpleasant parts of the process is natural, building healthier coping mechanisms, like prioritizing self-care, is better for your long-term success. While you can get away with avoiding your feelings for a while, eventually, you need to acknowledge each one so you can move on. If you don’t work through those difficult emotions, your ignored feelings will come out sideways at just the wrong time. It is better to work through your grief privately than to fall apart during an interview or snap at someone who is trying to help you. Step 2: Review Your FinancesDisclaimer: While I know quite a bit based on my previous work experience supporting financial coaches, my own research, and my personal life experiences, I do not currently hold a license or certification to give financial advice. Therefore, the information provided here is educational information provided as guidance. I hope you can glean value from my lessons learned. Feel free to take my recommendations or not—but whatever you do, double-check my information (and everyone's facts, for that matter). This is your life, and you will care more about your finances and health care than anyone else. With that, read on. Possible Money From Your Former EmployerAlthough your paychecks will eventually stop, you will receive your final paycheck, possibly vacation time that you have earned and, hopefully, a lovely parting gift from your former employer in the form of a severance package. Severance could be equivalent to a set number of weeks of pay or include an additional lump sum, continuation of some benefits, and job placement services. In most cases, employers do not have to give you any type of severance. If you are eligible for a severance package, you will need to sign something before receiving that money. Once you sign, any thoughts you might have about legal action regarding your employment with the organization are pretty much over. Read the agreement given to you, consider having a lawyer look it over, and ask for clarifications (and any revisions) before signing it. After that, there is typically a waiting period before you receive that money. I also encourage you not just to sign whatever paper they put in front of you. Make sure you advocate for yourself. Unemployment IncomeAfter a layoff, most people will be eligible for unemployment insurance income, or UI. I encourage you to apply for unemployment payments. The money used to make unemployment payments comes from the payroll taxes that employers pay. That money is intended to help people who have been laid off to pay their bills as they search for something new. Unemployment payments are administered at the state level and vary by state. After you apply, there may be a waiting period before you receive a payment. Your state will also outline the amount of each payment you will receive, the number of payments you are eligible to receive, and additional factors impacting your payments. You may also qualify for job search support services and even programs to help you upgrade your skills. In short, apply for unemployment income right away. In most cases, there is not a good reason for most people to forgo unemployment payments. A Note About Health InsuranceSince many people rely on their employers for health insurance coverage, consider how you’ll cover healthcare costs. If you have a spouse, domestic partner, or parent who can bring you onto their health insurance, that may be your best option. Check with the other person’s employer and let them know you no longer have health insurance through your employer because of a layoff. Their employer can talk you through your next steps and cost changes. If that's not an option, consider COBRA coverage through your former employer. This means you could stay with your previous health insurance, but now you'd pay the whole premium cost. Brace yourself when you see your new premium amount because it is usually A LOT more than you spent as an employee. Another option is going on the insurance exchanges at Healthcare.gov to find coverage. You may even be eligible for a subsidy to offset the cost. Alternatively, for less expensive coverage intended to cover a big expensive medical issue should it happen, short-term health care insurance may be a good interim option. Do your research and determine what makes the most sense for you and your household. Step 3: Prepare For Your Job SearchNext, plan to launch your search for a new job. Start by thinking about what kind of job you want. Write down job titles, possible employers, and your target salary range. Update your resume to include details about your last position and showcase your unique skillset as it aligns with your target job. From here, start letting people know your new status of being “in transition” and ask for help. They might be able to introduce you to a valuable business contact, keep an eye out for job openings that meet your needs, and introduce you to a hiring manager looking for someone just like you. It Will All Work Out. It May Also Take A While.All told, I’ve had seven workdays that started with lots of obligations then quickly evaporated into unemployment. The good news is that it will all work out. The bad news is that there is a lot of uncertainty between your last day of work and your first day of your fancy new job when it does arrive. Using these tips will set you right as you begin your career transition. Seven Lessons From Seven Layoffs: A GuideIf you've recently been laid off, check out my book Seven Lessons From Seven Layoffs: A Guide. You can even buy the eBook to get help right now. In this book, I cover seven lessons from my seven experiences with unplanned job losses. I include my personal stories alongside practical advice for navigating this tumultuous time. You'll learn strategies for managing your mindset, finding the next right job for you, shaping your career story, and overcoming setbacks. Learn More |

Just get laid off?

Click here for info on what to do first. Author7-time layoff survivor Brenda L. Peterson, The Layoff Lady, waxes poetic on layoffs, job transitions, & career resilience. Buy The Book!Were you recently laid off from your job and need a roadmap for what's next? Pick up a copy of my book, Seven Lessons From Seven Layoffs: A Guide!

Categories

All

Archives

July 2024

|